The rating from the Bank of France assigned to DATASOLUTION

#BankofFrance #rating #BoF #E1

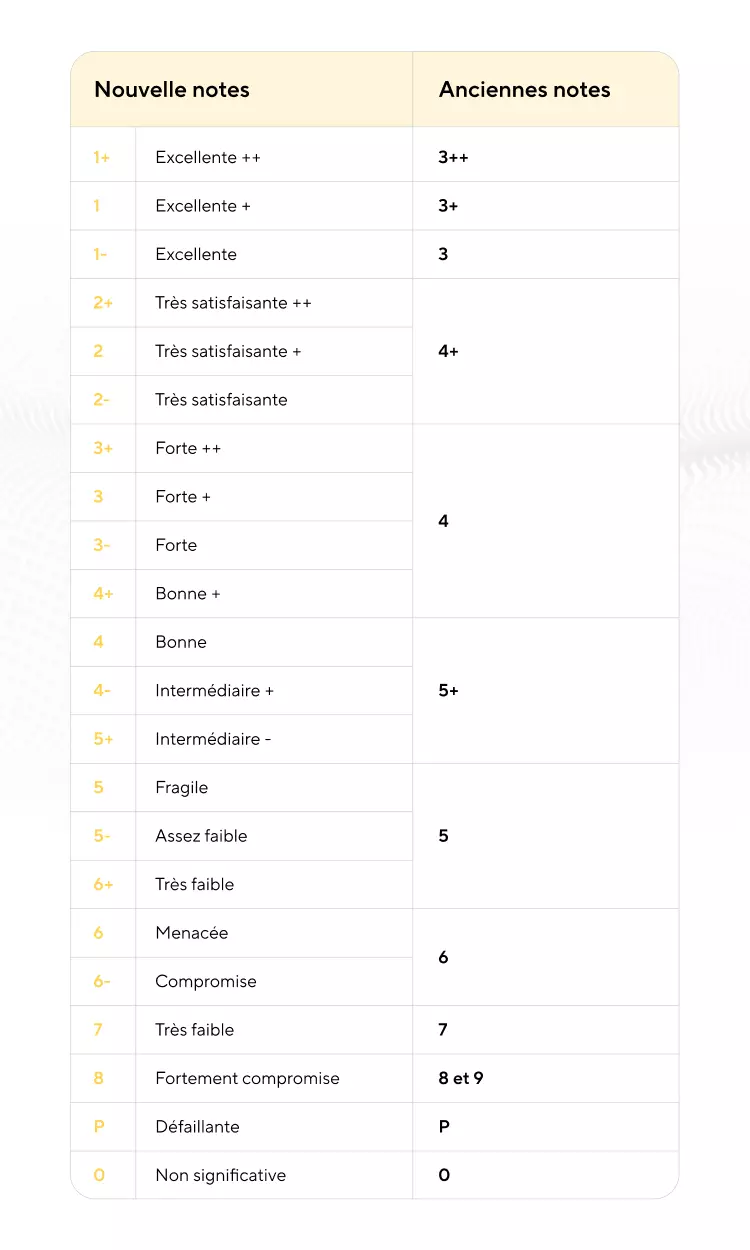

This year, the Bank of France is renewing its rating model with the implementation of the new scale since January 8, 2022.

To find out all about this new rating and understand the excellent grade (E1) achieved by DATASOLUTION, read the rest of the article!

What is the Bank of France rating?

The rating is an assessment of a company’s ability to fulfill its financial commitments within a 1 to 3-year horizon. A universally recognized reference, its primary purpose is to facilitate communication between the company and lenders. For the lender, it’s a reliable instrument for evaluating credit risks. And for executives, it offers an external and completely impartial perspective on the company’s economic and financial situation.

Why this new rating scale?

# Addressing the need for harmonization with European standards

The current scale was established nearly two decades ago, in 2004, well before the adoption of ICAS and OEEC statuses. This new rating reflects the desire to have a scale that is more intuitive and comparable to those of other ICAS and OEEC entities.

# More finely distributing companies across the risk scale

This new system allows for correspondences with all credit quality levels defined by the Eurosystem. It also enables a more refined evaluation of eligible and non-eligible companies.

# A scale better suited to the rating methodology

Having significantly evolved since 2005, partly due to economic and regulatory changes, as well as statutory requirements.

The new levels are now defined by default probability ranges rather than an average default rate.

#For innovation

To innovate but primarily to be in line with the use of recent statistical methods to construct the rating model.

This new framework also maintains the fundamentals and specificities of the Bank of France rating.

Finally, it ensures the continued use of expert analysis with much better traceability and a model still based on the company’s financial ratios and aggregates.

With this new scale, the rating system contributes to strengthening the robustness of the financial system and the quality of economic financing by enabling:

- More precise evaluation of the financial situation of rated companies, allowing finer distribution on the risk scale.

- Banks to more discriminately determine the claims that can be presented for central bank refinancing, as well as the equity they must hold in relation to their credit activity.

- Supervisors to better assess the credit portfolio quality of banks.

- Companies to better understand their situation’s perception by their partners.

Given this explanation, DATASOLUTION would like to thank all its loyal partners who contributed to achieving this rating of 1, which is the highest level for an independent company.

THE E1 RATING !

DATASOLUTION IS AWARDEDIn this new system, we still have two components:

- An activity rating, represented by a letter corresponding to the company’s size based on its turnover.

- A credit rating, expressed within a scale comprising 22 levels of significant values.

After analyzing DATASOLUTION’s consolidated balance sheet, the E1 rating has been assigned to us.