Shopify Payments is coming to France, and it’s time to get your online store ready!

We’re familiar with the major Payment Service Providers (PSPs) in the market that can integrate with your Shopify e-commerce: Stripe, Adyen, Mollie, and more.

The most suitable solution for Shopify would, of course, be to offer its own payment interface in as many countries as possible. France is indeed in the sights of the Canadian provider, allowing its local e-merchants to use Shopify as seamlessly as possible. The specific rules and organization of the GIE Carte Bancaire had, however, recently delayed the launch of Shopify Payments in France.

That’s now a thing of the past – Shopify Payments is here to the delight of purists and enthusiasts of this turnkey e-commerce solution. We’re sharing all the details right here!

Shopify Payments ?

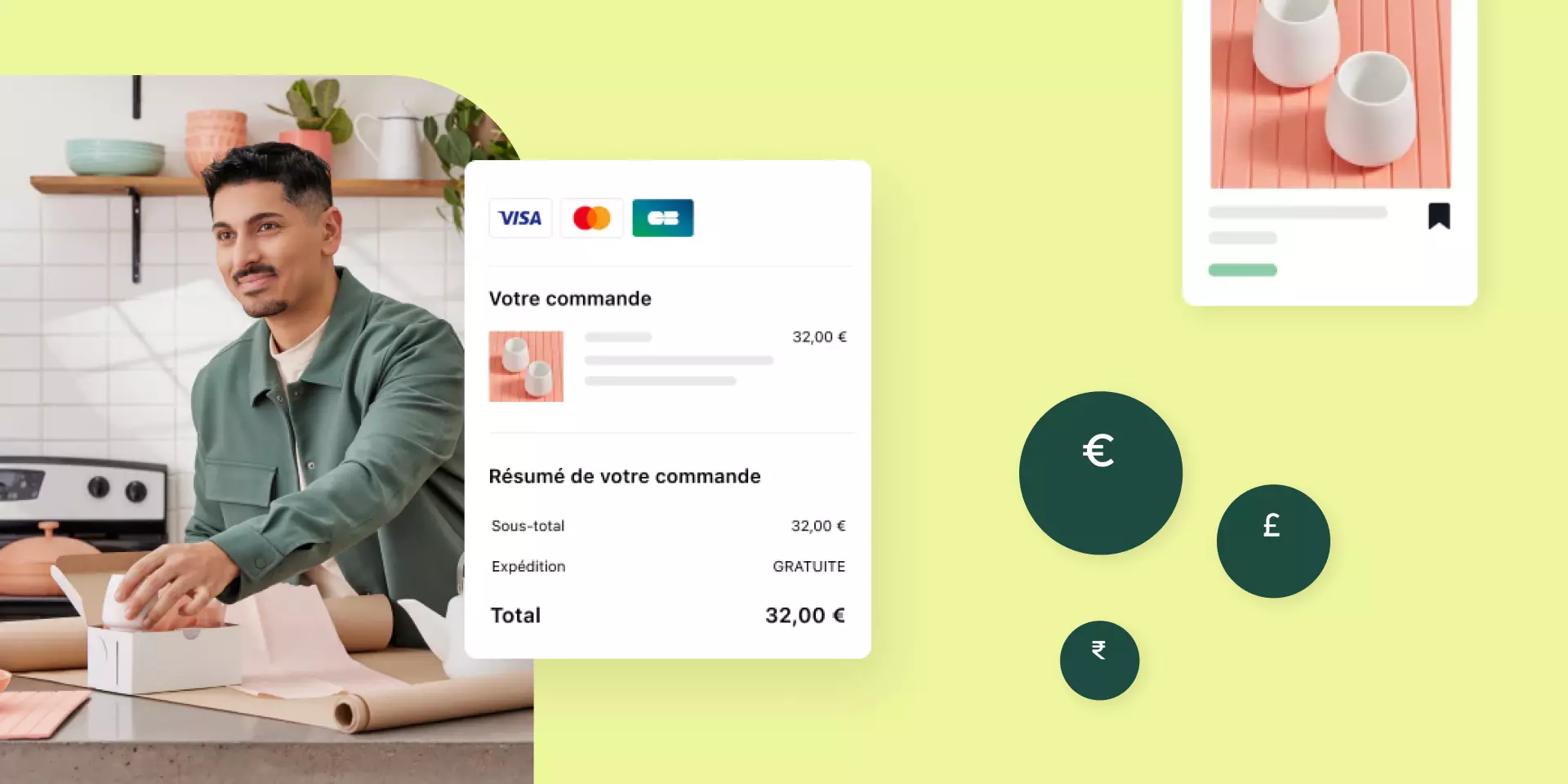

Shopify Payments is an internal payment provider within Shopify. As you may have understood, it’s a payment gateway seamlessly integrated into your Shopify store. When customers visit your e-commerce site, add items to their cart, and proceed to checkout, Shopify Payments comes into play, handling all stages of the payment process.

This means that if you’ve encountered issues with certain Payment Service Providers (PSPs), you can switch to this native model, which eliminates many intermediaries. You’ll be able to use Shopify Payments on both regular Shopify and Shopify Plus plans, even in B2B transactions.

The Benefits of Using Shopify Payments

With Shopify Payments, the payment process becomes faster, smoother, and additionally, highly secure due to its 100% integration (for instance, no need for external PSP to update its module when the platform’s APIs evolve).

Shopify Payments enables powerful features to be activated, such as international management for a single store through Shopify Markets (taxes, shipping, payment methods) or even one-click payment through Shop Pay.

The extra advantage: Shopify Payments comes with fraud analysis. This Shopify payment processing automatically runs an analysis to detect any suspicious activity. As a result, it safeguards you from fraudulent orders or fake transactions.

Breakdown of Shopify Payments Fees

1. You no longer have Shopify transaction fees (the fees Shopify charged you for each transaction). Once you opt for Shopify Payments, you no longer have transaction fees related to using an external PSP.

However, please note that if you continue to use an external payment method (e.g., Bancontact, Klarna, Mollie), transaction fees will apply to these external payment methods.

2. You will have the standard payment processing fees: These are the fees charged by your payment provider for processing all transactions, including data transmission between buyers, sellers, issuing banks, and acquiring banks. Typically, this fee is around 1.3% for Shopify Payments.

But then, Shopify Payments or Stripe?

While Shopify Payments will make life easier for many online businesses, it’s not the only solution for online business owners. Besides Shopify Payments, Stripe is known to be one of the leading online payment providers. There used to be talk of “Shopify powered by Stripe.” Now, they will be competing in France.

The question is: which one is better?

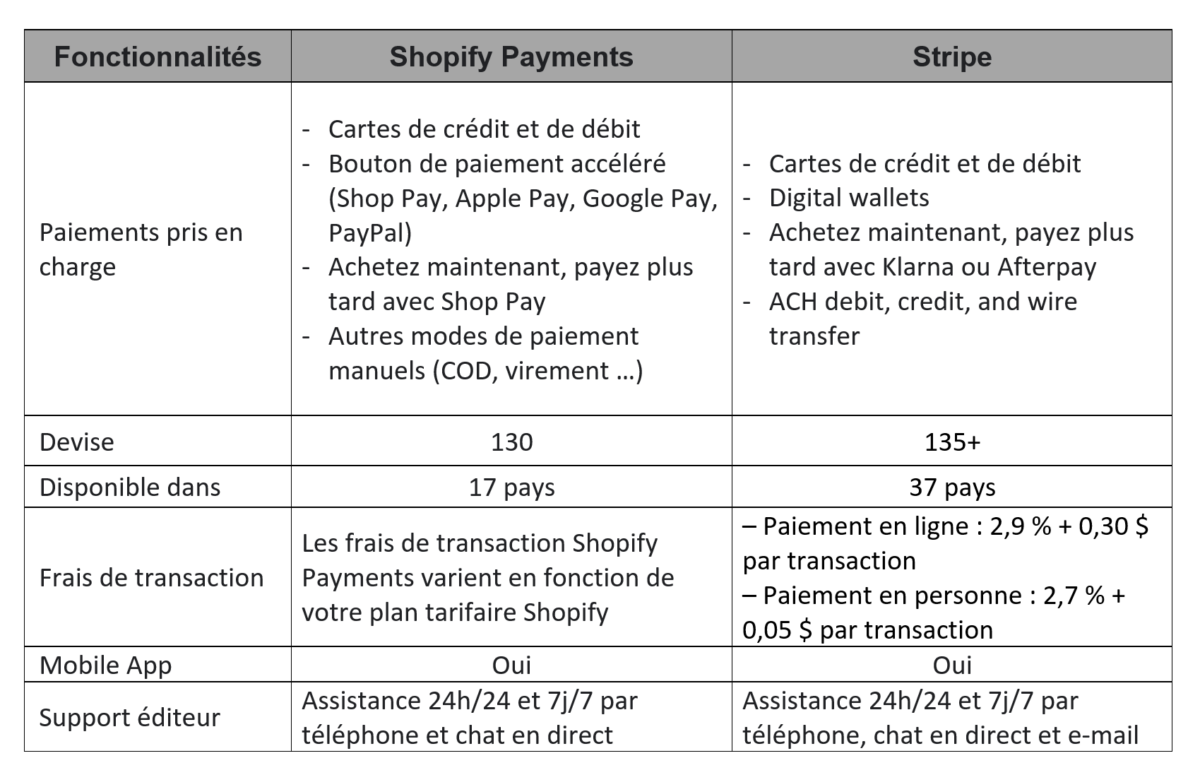

This quick comparison table can help you gain a clearer understanding.

Using Shopify Payments doesn’t prevent you from benefiting from other PSPs

Opting for Shopify Payments doesn’t mean you have to give up other payment providers. In fact, you can choose as many payment methods as you want on Shopify. Having more payment options on your store can also mean more ways to convert customers! This includes PayPal and other PSPs offering options like 3/4X interest-free payments with providers like Alma, Klarna, or Mollie.

How to Set Up Shopify Payments in Your Back Office

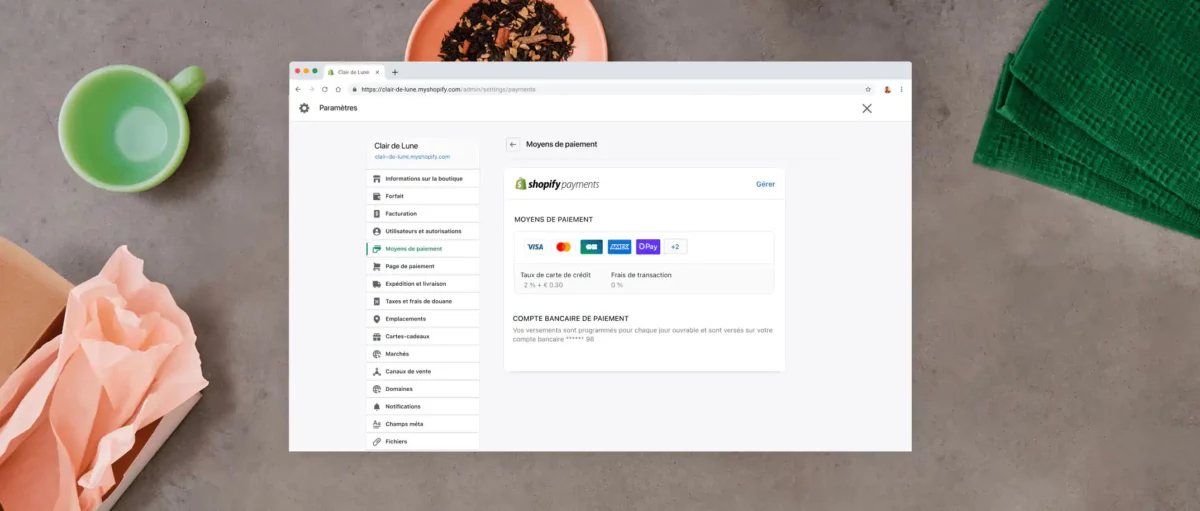

To get started, you first need to configure and activate Shopify Payments. In your Shopify settings, you can activate Shopify Payments from the Payment Providers tab in your back office.

Next, decide on the currency for your store. This is a crucial part of the setup process as it will impact your product prices and sales reporting in your Shopify admin interface. If you want to select a new currency unit, go to Settings → General → Store Currency.

After clicking on the Settings section on your left sidebar, you’ll find a Payments section: here, you can enable and manage the payment providers for your store. Select Shopify Payments as your payment provider.

In the Accept Credit Cards section, you’ll see Shopify Payments at the top of the list of payment providers. As you’ll notice, Shopify has briefly listed some basic information such as credit card rates, transaction fees, and accepted payment methods. If merchants are researching other payment providers like PayPal or Amazon Pay, they can quickly gauge the competitiveness of the pricing.

To proceed, simply click “Complete account setup” and provide all the necessary information to Shopify. And there you have it, Shopify Payments is no longer a mystery to you!

If you want to learn more, don’t hesitate to reach out to us.